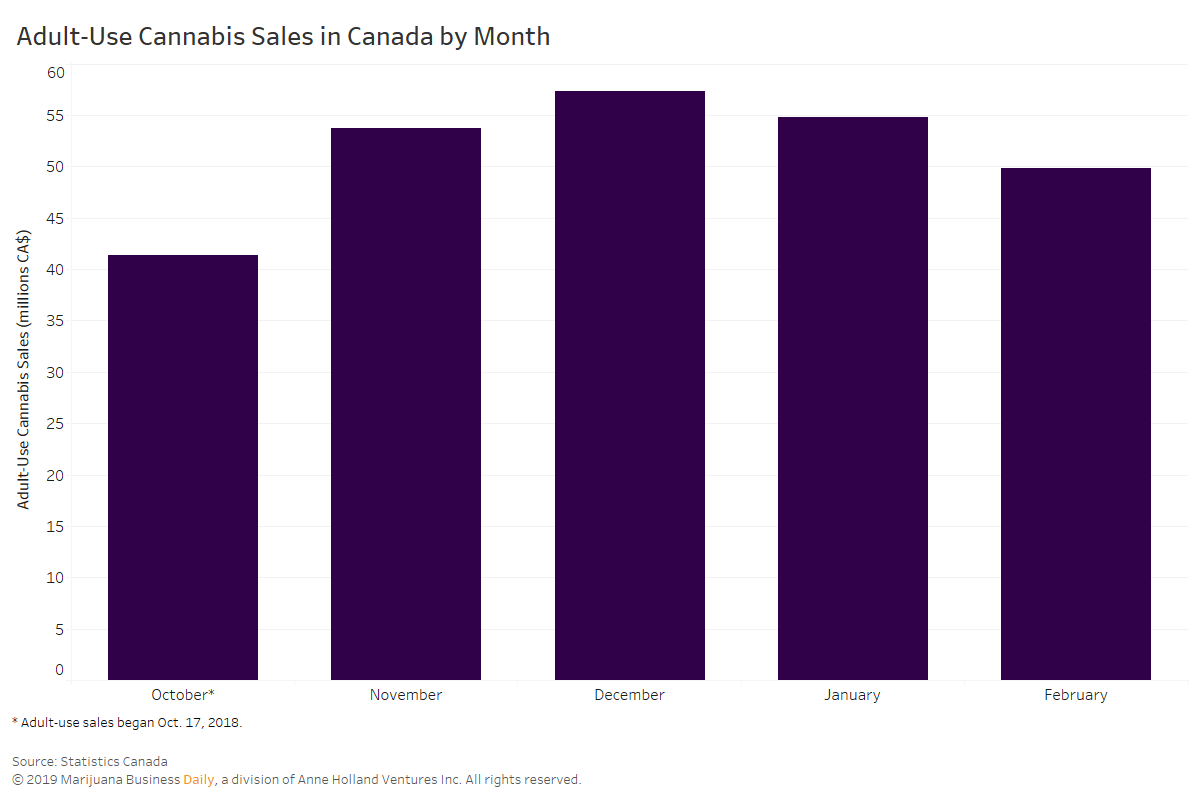

Hobbled by the bungled rollout of physical stores and inconsistent inventory at the monopoly online retailer, sales of legal adult-use cannabis in Ontario hit a fresh low in the month of February.

Receipts at the Ontario Cannabis Store declined to just 7.5 million Canadian dollars ($5.6 million), down from almost CA$9 million in January, according to Statistics Canada data.

The data does not take into account sales at the first brick-and-mortar stores in the province, which opened nearly six months after Canada legalized recreational marijuana.

Ontario’s sales have been so poor that the Bank of Montreal (BMO) warned that revenue from the fledgling industry would come in lower than expected over the coming quarters.

“The pace of new bricks-and-mortar store openings, particularly in Ontario – beginning April 1 – will likely be gradual, which may also limit the level of recreational sales over the coming quarters,” the bank noted in an April 1 report.

Across Canada, Alberta led the country with CA$12.3 million in marijuana sales, followed by Quebec’s CA$11.3 million.

Newfoundland saw sales decline 35% in the shortened month of February.

British Columbia’s sales were only CA$1.9 million for the month.

Manitoba saw the best improvement, with CA$4 million of adult-use cannabis going to consumers in February, up from CA$3.8 million the previous month.

The Ontario Cannabis Store is projecting a CA$25 million loss this year – on top of the CA$6.8 million it lost in 2018.

Key to reversing Ontario’s declining cannabis sales will be the rollout of more physical stores.

Ontario recently announced plans to prequalify privately owned cannabis retailers and remains committed to lifting the province’s limit of 25 stores by the end of 2019 – pending a reversal of what it calls a “national cannabis shortage.”

Sales of new products – edibles, extracts and topicals – are also expected to give the market a jolt.

These classes of products are required by law to be added to Schedule 4 no later than Oct. 17, 2019, but experts note that the products won’t hit the market until the end of the year – and more likely in the first half of 2020.