Several of the nation’s largest cannabis companies are curtailing retail expansion plans for 2024, a consequence of licensing caps, limited new market opportunities and ongoing capital concerns.

Those realities will curb expansion in several states this year as numerous multistate operators focus on core business lines rather than increasing operational expenses, industry sources told MJBizDaily.

Despite the hurdles, some legal U.S. markets are projected to increase the number of marijuana retailers significantly.

MSOs this year are expected to add dozens of new adult-use stores in Ohio, largely thanks to a 2023 voter-approved ballot initiative that prioritized expansion for existing medical cannabis operators.

In New York, a handful of vertically integrated MSOs – The Cannabist Co., Curaleaf Holdings and PharmaCann, for starters – received a green light from regulators in December to serve adult-use customers.

The policy shift approved by New York’s Cannabis Control Board granted six “registered organizations” (the state’s terminology for MSOs) a key allowance so each can serve adult-use customers at three of their existing MMJ dispensaries.

MSOs also are expanding retail outlets in Florida, New Jersey and Virginia, but growth drivers vary significantly.

Operators are aiming to hit their licensing caps in New Jersey and Virginia.

Conversely, in Florida – a market without licensing caps or wholesale distribution – scaling retail is king.

MJBizDaily spoke with executives at several marijuana MSOs to chart their retail growth plans this year. (Several MSOs, including Acreage Holdings, Green Thumb Industries and Trulieve Cannabis Corp., did not respond to MJBizDaily inquiries.)

The passages below highlight key developments at five MSOs:

The Cannabist Co.

The New York-headquartered company formerly known as Columbia Care has little room to expand its retail footprint, despite having vertically integrated operations in 16 states.

“For the most part, we’re built out and basically capped,” said Jesse Channon, The Cannabist’s chief commercial officer.

The company, however, has singled out three states for retail expansion in 2024: New Jersey, Virginia and Maryland, which launched adult-use sales July 1.

The Cannabist, which operates two stores in New Jersey, is looking to add another retail location, according to Channon.

“We still have a third one to open, which is a really exciting opportunity for organic growth,” he added.

In Virginia, the company is in the early stages of building out its fourth location in the Richmond area.

“At this point, we anticipate opening in Q2/Q3 of 2024,” Channon said.

“We are still in the property-pursuit phase for the fifth dispensary.”

The MSO also is bullish on Maryland, where it’s expanding into larger facilities to keep up with customer demand, as well as Ohio and Pennsylvania.

“Those are markets that we’re keeping an eye on as well,” Channon said.

Cresco Labs

Chicago-based Cresco Labs operates five medical marijuana dispensaries in Ohio under its Sunnyside brand and plans to expand its retail footprint in the state.

When Ohio became the 24th state to legalize recreational marijuana in November, ballot Issue 2 included a provision providing existing MMJ operators such as Cresco with a first-mover advantage when adult-use sales kick off later this year.

Language in the ballot initiative also provided the state’s largest vertically integrated license holders – referred to as Level 1 operators – the option to add three stores beyond their licensing cap of five dispensaries.

Meanwhile, Cresco plans to add stores in Florida, where it already has a 33-outlet footprint.

“That’s the only way you can grow in Florida, because you can only sell your product,” Cresco spokesperson Jason Erkes told MJBizDaily during a 2023 interview at the company’s flagship store adjacent to the Chicago Cubs’ Wrigley Field.

Beyond brick-and-mortar, Cresco is trying to grow the customer base organically at its 70 stores nationwide through educational outreach and other campaigns.

Cresco has one overarching goal in mind.

“It’s converting people from the illicit market and getting them to walk into a regulated dispensary,” Erkes said.

“It’s getting them to shop here instead of a CBD shop or a delta-8 (THC) shop selling stuff that you have no idea where it came from, that’s not lab tested, not regulated and, frankly, in some cases, not legal.”

Curaleaf

The New York-headquartered company has been part of its home state’s medical cannabis program since that market’s January 2016 debut.

Curaleaf was among the half-dozen operators approved last month to sell marijuana products to adult-use customers in New York as early as Dec. 29, 2023.

The regulatory policy shift effectively eliminated a three-year waiting period for the state’s 10 original vertically integrated MMJ providers.

Curaleaf plans to launch adult-use sales this month at its dispensary in the Hudson Valley region of New York, pending regulatory approvals, according to CEO Matt Darin.

The company also has a Level 1 retail designation in Ohio, where it plans to add stores this year.

“That is going to be a really exciting adult-use market, given the population there and good regulatory structure,” Darin said.

Ohio has nearly 12 million residents – about three-quarters of whom are older than 21 – so the legislation will vastly expand access to consumers beyond the state’s 180,000 existing medical marijuana cardholders.

PharmaCann

Chicago-based PharmaCann’s New York subsidiary also is eyeing expansion in the potential multibillion-dollar East Coast market after gaining approval from regulators to serve adult-use cannabis shoppers.

“New York remains at the top of the list when it comes to business opportunities,” PharmaCann spokesperson Jeremy Unruh said via email.

“While there are still some complexities in that market, we are cautiously optimistic that things are beginning to move again in the Empire State.”

PharmaCann had vertically integrated operations in eight states as of early 2024.

Verano Holdings Corp.

The Chicago-based MSO, which operates five medical marijuana dispensaries in Ohio, can add one adult-use store in the state under its Level 2 designation.

In Connecticut, Verano opened two stores last year under the state’s social equity joint-venture (JV) program and can add another four JV locations based on its operational footprint.

The timetable for those build-outs and partnerships has yet to be finalized, according to Chief Investment Officer Aaron Miles.

A similar social equity JV program exists in New Jersey, another market Verano is eyeing for growth.

“We are not up and running with any stores in New Jersey yet,” Miles said.

“I think we can open seven in the state of New Jersey, and we are working diligently on that right now.”

Chris Casacchia can be reached at chris.casacchia@mjbizdaily.com.

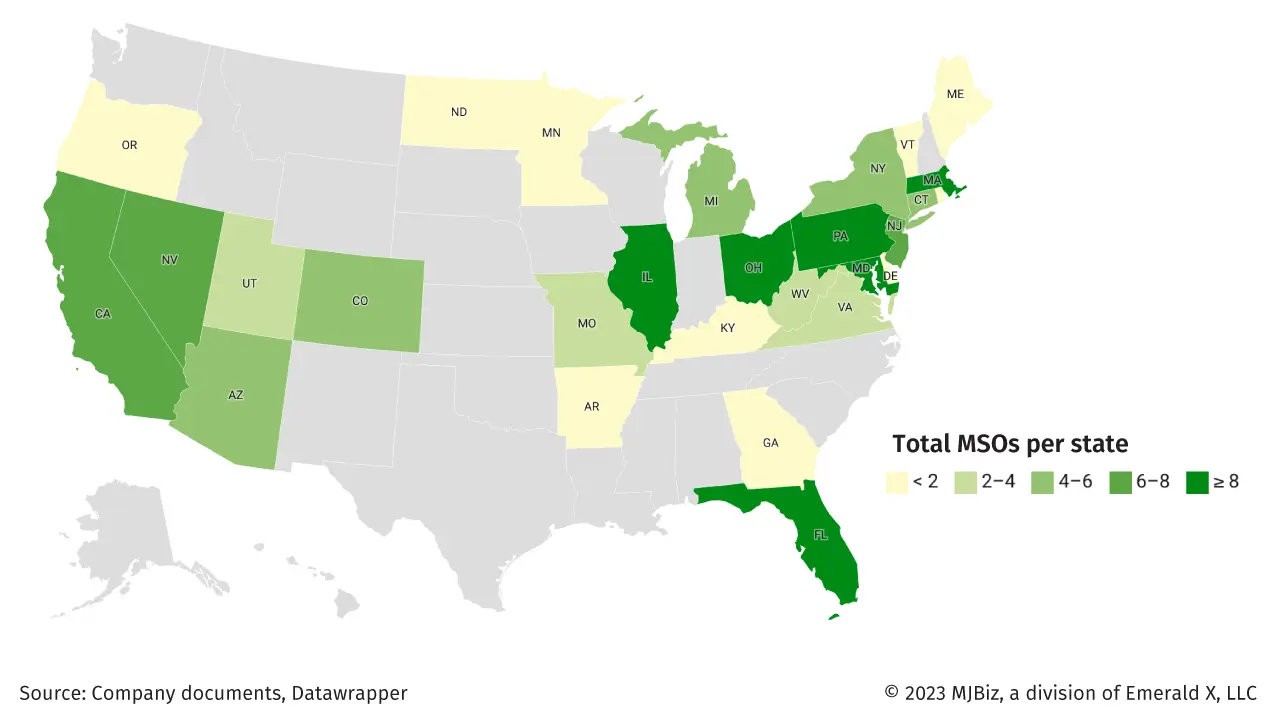

Wondering where major MSOs are located? MJBizDaily‘s interactive map will show you.