(This story has been updated to clarify that a Weedmaps representative responded to Marijuana Business Daily’s requests for comment but declined to go on the record about certain subjects.)

(California Marijuana Notebook is a regular column that delves into the complicated issues surrounding the state’s immense cannabis market from the vantage point of Marijuana Business Daily Senior Reporter John Schroyer. Based in Sacramento, he’s been writing about the cannabis industry since joining MJBizDaily in 2014.)

It appears one of the longest-standing controversies in the California marijuana industry will come to a close by New Year’s Eve.

California Gov. Gavin Newsom made clear during a news conference earlier this month the company will be held to account if it doesn’t follow through on a pledge to drop all unlicensed retailers from its site by the end of 2019.

He added that California-based Weedmaps has a “legal responsibility” to do so.

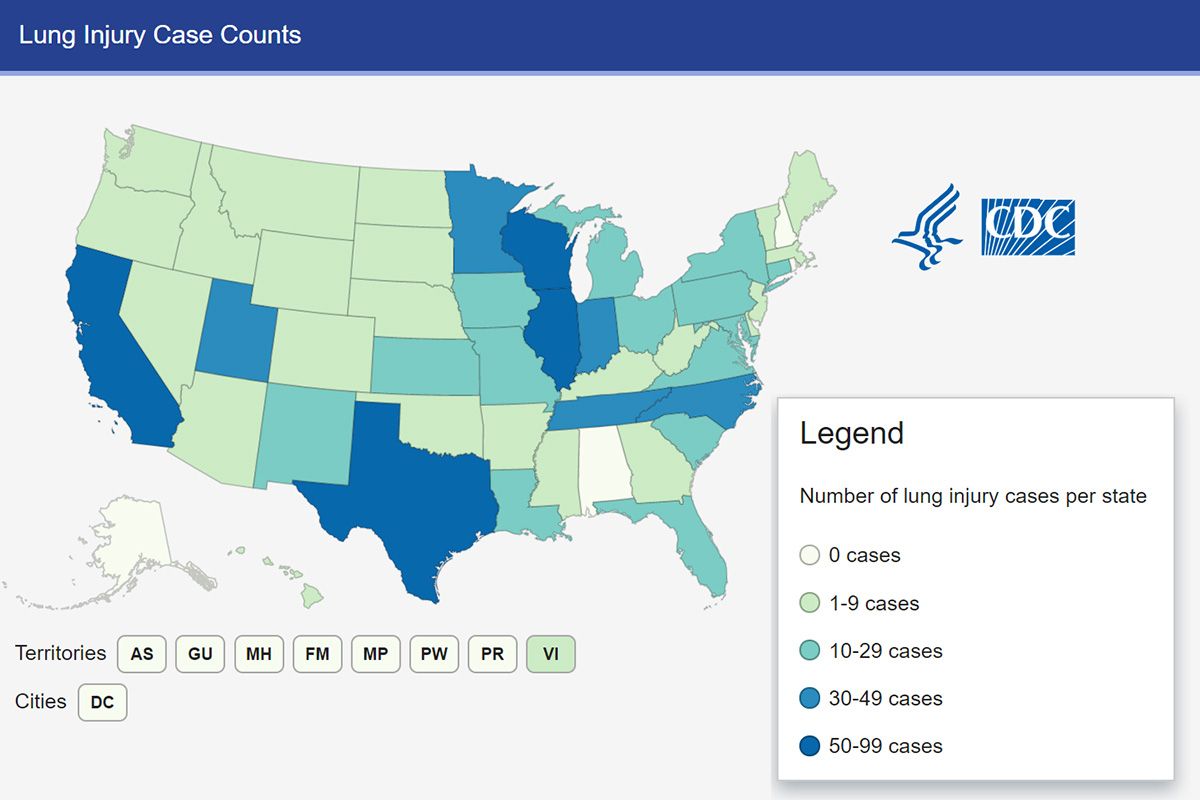

While taking questions from reporters about the vaping illness epidemic and an executive order he’d signed, Newsom was asked why Weedmaps was given until the end of the year.

The governor responded that the company is removing unlicensed ads in “real time.”

“Every day, they better be dropping folks, and we’ve been monitoring that,” Newsom said.

A Weedmaps representative responded to requests for comment on that topic and multiple related questions but declined to go on record on certain subjects.

However, a company spokesperson wrote in an emailed statement to MJBizDaily that Weedmaps has at its disposal more than 500 employees, a host of brands, physicians, retailers and delivery services – and “millions of loyal consumers who rely on us for the most up-to-date access to medical and adult-use cannabis.”

“As the technology platform powering the industry, we will continue to introduce new products, services and programs over the coming months and years,” the spokesperson wrote.

“While our business will evolve, our commitment to increasing access to medical and adult-use cannabis will not change, nor will our focus on ensuring markets are open, equitable and safe.”

Going public in Canada?

From all accounts, Weedmaps has been in talks with the governor’s administration, based on language from Newsom himself and one of his lieutenants, cannabis business czar Nicole Elliott.

Some industry observers believe the administration may have given Weedmaps an ultimatum of sorts, since Assembly Bill 97 gave the state the power to fine Weedmaps up to $30,000 per day per violation for carrying ads on behalf of unlicensed cannabis businesses.

Another potential motivation is that the company has explored going public in Canada, several sources told MJBizDaily.

If Weedmaps is serious about going public on the Canadian Securities Exchange (CSE), it would have to follow the exact steps it’s already taking, said Cheryl Reicin, a Toronto-based attorney.

“There is no opening to have cannabis companies acting in violation of state laws in the U.S. to go public in Canada,” Reicin said.

Reicin added if Weedmaps is serious about listing publicly in Canada, the company may have to form a “new entity” and also scour its financial coffers of any revenues from illegal retailers.

If it didn’t, that would prove tantamount to money laundering in the eyes of Canadian securities regulators, she said.

“If I today say, ‘Going forward, we’re not taking any money from illicit operations, (but) we still have in the system some money, and how do we now cleanse it?'” Reicin said.

“Maybe they would have to set up a new entity, maybe they would have to figure out a way of disgorging some of that money. I don’t know. But they’d have to be fully legal, compliant and there would have to be some cleansing.”

Weedmaps’ connections to illegal retailers isn’t limited to California; similar concerns have popped up in Michigan and Arizona.

Easy fix?

The switch to only legal retailers for online marijuana sites is also a fairly easy one, said representatives from Leafly and Wikileaf – Weedmaps’ competitors that are both based in Seattle.

Leafly spokesman Matt Justine said when his company dropped all retailers except for state-licensed businesses in early 2018 – a total of 750 in California and another 200 in Canada – it cost the company a “significant” amount of money.

“If it goes anything like it did over here, they should be able to act in short order and make this a reality,” Justine said when asked how difficult it may be for Weedmaps to remove unlicensed ads from its site.

Justine added, however, that Weedmaps also still carries ads in Canada for unlicensed MJ shops, which could prove yet another deterrent to CSE regulators unless Weedmaps’ decision is across the board for every market it operates in.

Dan Nelson, CEO of Wikileaf, said his company had to do a lot of prep work before going public on the CSE in mid-September, and he sees Weedmaps following suit with its recent announcements.

Going public was one of the primary reasons he said Wikileaf stopped working with unlicensed MJ businesses.

“We were eyeing the public markets, particularly the CSE, which I’m pretty confident is what Weedmaps is doing right now. And if you want to list on the CSE, that’s a prerequisite,” Nelson said.

How difficult may it be for Weedmaps to remove all illegal retailers from its site, based on Wikileaf’s experience?

“It would definitely be a simple thing for them to do,” Nelson said.

Weedmaps, for its part, declined to talk on the record about any potential revenue loss stemming from the deleting of unlicensed retails.

Jerred Kiloh, president of the Los Angeles-based United Cannabis Business Association (UCBA), estimated the loss in revenue would total about $8 million a month based on surveys the association has conducted with California retailers who pay Weedmaps for ad listings.

But Reicin said that going public in Canada could dwarf that number.

“Six months ago, companies were raising hundreds of millions of dollars” through initial public offerings on the CSE, Reicin said.

Amazon of marijuana?

What will probably happen, predicted longtime L.A. consultant Avis Bulbulyan, is Weedmaps will start funneling consumers to legal retailers, delivery services and brands that likely will still be paying them a premium of some sort.

“Weedmaps is probably in the best position to be that next Amazon,” Bulbulyan said.

“I think that’s where their business model is going to pivot, and they’re going to start having a direct interest in all these transactions that are happening, in addition to being paid to advertise for those brands.”

(Click here to read the previous installment of this ongoing column.)

John Schroyer can be reached at johns@mjbizdaily.com