(For more analysis and in-depth looks at the investment trends and deals driving the cannabis industry forward, sign up for our new premium subscription service, Investor Intelligence.)

Abner Kurtin spent almost his entire professional career in the hedge fund and investment industries before founding Boston-based Ascend Wellness in 2018 and trying his hand as the CEO of a multistate cannabis company.

While managing investment risk and managing companies are two different endeavors, Kurtin’s experience in the hedge fund world helped him in the cannabis realm.

Barely a year old, Ascend has raised more than $100 million, including a $55 million round in February, and does business in Kurtin’s home state of Massachusetts, plus Illinois, Michigan and Ohio.

Rather than breaking into markets by winning licenses, Ascend raises capital and then buys licensed assets.

Kurtin started his career at The Baupost Group in Boston – among the biggest hedge funds in the world by assets under management – and founded his own hedge fund firm, Boston-based K Capital Partners, where he managed more than a billion dollars in assets.

He parlayed his investment experience to start Boston-based, cannabis-focused investing firm JM10 Partners, which put $50 million into 17 companies, including multistate firms such as Green Thumb Industries in Chicago.

Marijuana Business Daily spoke with Kurtin about building a multistate operation (MSO), marijuana investing and how the hedge fund world prepared him for both.

After spending years on the investment side, what made you want to go into operations?

I started an MSO because I really felt there was an opportunity. Historically, most MSOs had been built by license winners who were very focused on medical programs.

I felt that the world was changing with recreational, and that a lot of the recreational states, like Michigan and Massachusetts, were less and less about state license applications and more about buying and assembling assets.

So, Ascend became a vehicle that was built with opportunity capital to go after recreational markets, but it was much more of financial enterprise than an application focus.

How did you go about pitching investors?

We focused on return on investment and our background managing large amounts of capital. The pitch was about the opportunity to make a really smart and savvy investment based on what was going on in the conversion to recreational.

The general thesis was that if the government restricts supply, you earn excess returns if you execute well. It was about buying and owning limited licenses and earning high rates of return from doing so.

How did you come up with this strategy?

We felt in early 2018, the market had dramatically changed. We were on the verge of recreational in a lot of states, particularly our home state of Massachusetts.

We believe going into a recreational market requires $40 million per market, roughly. We felt there could be a second generation of MSOs, built around assembling assets – not winning assets – and deploying larger amounts of capital quickly to take meaningful amounts of market share in early recreational markets.

This was going to be a lot more capital intensive a lot quicker, and there was a much larger addressable market in rec states.

We were about financial assets, which could be turned on quickly. We talk a lot about building out the assets, turning them on, generating significant cash flow in recreational markets.

How did you decide on the $40 million number?

There’s a huge delta in that number. But roughly you need to build a scaled cultivation, and that’s going to cost you $20 million to $30 million. In limited-license markets, if you don’t grow your product, you can’t fill your stores. It’s a requirement. And it gives you a huge competitive advantage.

The smaller operators that have raised less money are going to do smaller grows, and as result, they’re not going to be able to take meaningful market share. They’ll be niche players, which is fine. They can do very well.

But there’s an advantage to getting to scale that really requires a grow that’s going to cost $20 million to $30 million.

Large scale means a 100,000-square-foot facility with a 50,000-foot canopy. If you do that, that’ll put you in the top three-five in every state except large Western states like California and Arizona.

How has your Wall Street experience helped you?

Most MSOs have employed the strategy of a land grab, which is to try and get the largest addressable market in the most states as possible. That’s a shotgun approach.

We apply more of a rifle approach: How can we raise a pool of capital and allocate that in the most efficient manner to generate the highest value for our investors?

We did that by focusing on the states that were mature medical and early stage recreational (markets). We believed those markets have the most attractive financial characteristics.

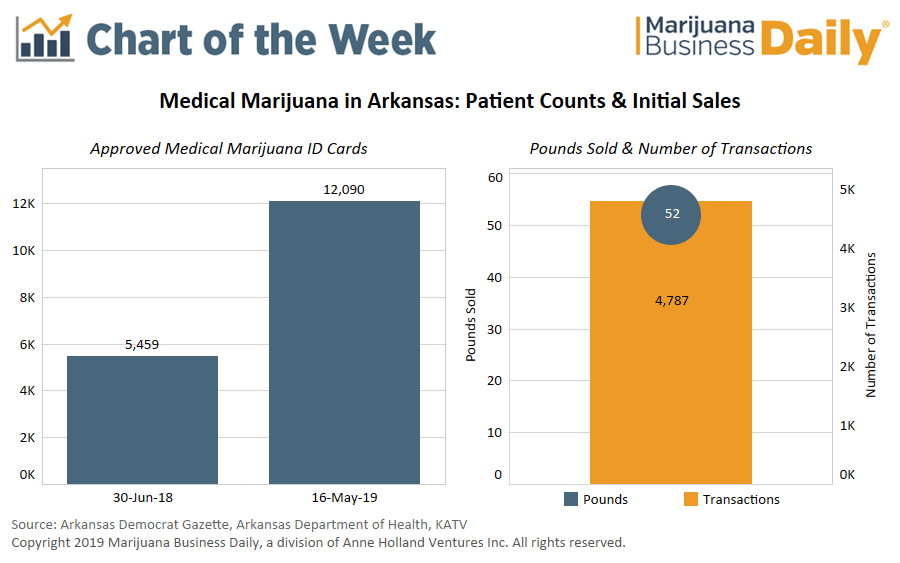

We define mature medical as when the penetration is over 1% and early recreational as the first few years of recreational before the competition gets too intense. Those are when you have the highest rates of return in the industry.

This interview has been edited for length and clarity.

Omar Sacirbey can be reached at omars@mjbizdaily.com