As marijuana companies across Canada brace for the historic rollout of the country’s recreational program next week, some businesses have their sights set on bigger opportunities they see coming in the United States.

Canadian cannabis investment firms and holding companies are making multimillion-dollar bids on a range of U.S.-based cultivators, manufacturers and retailers already.

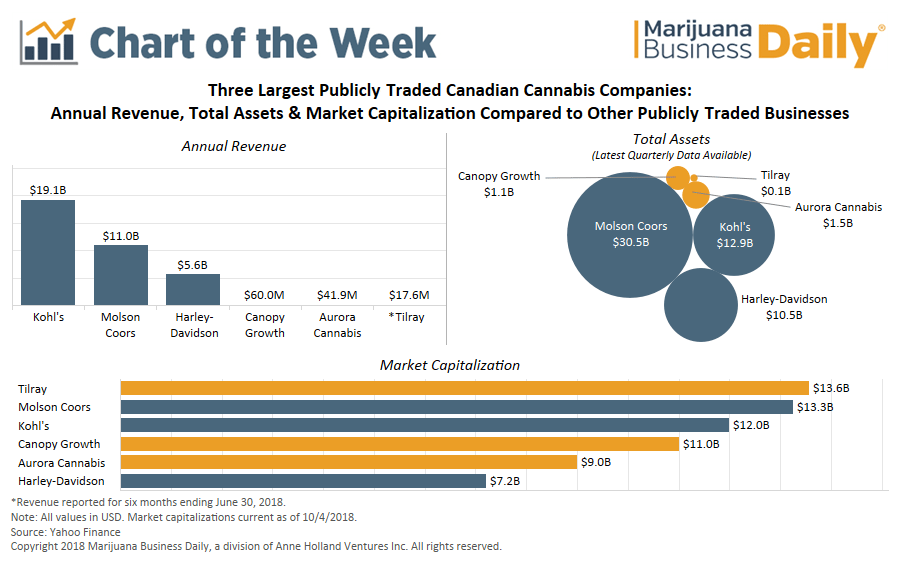

Relatively low valuations of U.S. cannabis companies – versus their Canadian counterparts – is helping fuel the interest.

Canadian cannabis companies also are striking deals on the expectation that federal legalization ultimately will come to the United States and boost the price tags of acquisition targets.

Here are three aspects of the current investment environment to consider:

1. Cross-border acquisitions are heating up.

During the first three quarters of the year, at least 40 U.S. cannabis firms have been acquired by Canadian companies, more than double the 17 deals inked during the same period in 2017, according to data from New York-based Viridian Capital Advisors.

The most recent deals include:

- British Columbia-based Tidal Royalty announced plans to acquire Florida-based Alternative Medical Enterprises for $8 million. The firm is also making a $12.5 million investment in Oregon-based cannabis cultivator Diem Cannabis.

- Toronto-based Captor Capital acquired Chai Cannabis, a medical and recreational cannabis store in Santa Cruz, California, for roughly $6 million. The acquisition adds a fourth California retail shop to Captor’s investment portfolio, which includes two MedMen-branded dispensaries, according to a news release.

- HollyWeed North Cannabis, a Canadian consulting firm that also has multiple marijuana brands, signed a letter of intent to acquire U.S.-based Women Grow.

The investments have landed despite reports of increased concerns among Canadian cannabis investors of running into issues crossing the U.S. border.

Admissibility to the United States may be denied merely because someone is “working or having involvement in the legal marijuana industry in U.S. states where it is deemed legal or in Canada” as cannabis remains federally prohibited, Customs and Border Protection (CBP) officials have told Marijuana Business Daily.

However, the “relatively steady increase of (merger and acquisition) activity does not seem to indicate any significant market worry about immigration bans at the border,” said Harrison Phillips, vice president at Viridian.

2.’Time to invest in the US is now.’

The boost in activity is being fueled by firms eager to tap the U.S. cannabis market ahead of what industry insiders expect will be a run-up in valuations and acquisition costs in the coming years.

“A lot of the conditions that we found attractive in Canada in 2013 and 2014 – meaning explosive growth and valuations that are still affordable – those conditions are very much repeatable in the U.S. cannabis industry now,” said Paul Rosen, CEO at Tidal Royalty.

The British Columbia-based company has raised more than $40 million as it pursues U.S.-based investments in cannabis cultivation, manufacturing and retail operations.

Rosen also is the co-founder and former CEO of the Cronos Group, one of Canada’s most well-known marijuana companies, valued at more than $1 billion and one of the few plant-touching companies to trade on the Nasdaq.

“We are turning away all other opportunities right now, because in our view – based on what we’ve done in Canada – the time to invest in the U.S. is now,” he said.

Tidal Royalty provides financing for cannabis operators via royalty agreements, through which Tidal gets a percentage of a company’s revenue for its investment.

“We’ve taken a (financing) product that exploded in the mining industry, and we’re solving a problem for U.S. cannabis firms – which is a shortage or lack of access to capital,” Rosen said.

Leaders at Ottawa-based CannaRoyalty share Tidal’s bullish take on the U.S. cannabis market. Like Tidal, the firm offers royalty financing deals, but it also pursues licensing, equity and secured debt deals.

In April, the firm signed a multimillion-dollar deal to acquire FloraCal Farms, a move that expands the company’s California footprint.

That deal followed CannaRoyalty’s acquisitions in March of three California businesses: RVR, a large-scale medical and recreational marijuana distributor; Alta Supply, a small MMJ distributor; and Kaya Management, an edibles and vaporizer maker.

CannaRoyalty is among a growing number of larger, publicly traded Canadian firms that are increasing their stakes in the California market, where there are no residency requirements for ownership of cannabis businesses.

“The moment that federal legality shifts in the states, institutional investors will begin rushing to get into cannabis, which will drive up competition and acquisition costs for every deal,” said Afzal Hasan, CannaRoyalty president.

“Ultimately, it’s critical to every cannabis business that the federally legality issue is resolved, but for the time being, we do stand to benefit.”

3. Will Canada’s biggest players miss out?

Canadian companies like CannaRoyalty and Tidal have another momentary advantage: Both trade on the Canadian Securities Exchange, which, unlike the larger Toronto Stock Exchange, allows public companies to do business in the cannabis industry in the United States.

Late last year, the TMX Group – parent of the Toronto Stock Exchange (TSX) and the TSX Venture Exchange (TSXV) – said companies with direct business ties in American marijuana companies could be delisted from its platforms.

That risk led a growing number of Canadian cannabis firms that trade on the TSX and TSXV to sell off or spin off their U.S.-based assets.

Among the most recent moves:

- In September, Ontario-based Aphria completed the divestiture of all its U.S. cannabis assets with the sale of Florida-based Liberty Health Sciences. In a release, Aphria CEO Vic Neufeld called the move “only a temporary departure from investment in the U.S. cannabis industry.” He added that Liberty will remain a “strategic partner” and that Aphria “intends to be significant player in the U.S. cannabis industry at the appropriate time in the future.”

- Canadian marijuana producer Invictus announced in August that it is spinning off wholly owned subsidiary Poda Technologies into a stand-alone entity that can conduct business in the U.S. because the company will not be listed on the TSXV.

- Aurora Cannabis announced in June that it would spin off its U.S. subsidiary, Australis Capital. At the time, the company said the move would position Australis to focus exclusively on U.S. investment opportunities “primarily in the cannabis and real estate sectors.”

For those firms not listed on the TSX, “there’s an opportunity to invest in the U.S. now,” said Andrew Kessner, an analyst with New York-based investment advising firm William O’Neil.

“I think a lot of the larger companies will continue to watch the market closely, and they are banking on regulatory action that will fully legalize cannabis in some way in the U.S.”

Lisa Bernard-Kuhn can be reached at lisabk@mjbizdaily.com