(This story has been updated with additional information from the California Bureau of Cannabis Control.)

Well before the coronavirus pandemic hit the U.S., cannabis experts predicted significant contraction for the legal California marijuana industry this year.

Cannabis sales are currently brisk at many California marijuana shops as consumers stock up over the fear MJ retailers could shutter indefinitely – but even so, the business fallout surrounding coronavirus has pushed some California MJ firms closer to the brink as they deal with:

- Uncertainties related to potential shop closures that government officials might mandate by law.

- Unclear or changing rules from California municipalities.

- Long-term business anxieties that might follow even after coronavirus issues subside.

Additionally, San Francisco regulators ordered all marijuana retail to stop on Monday.

That move was offset by quick action by the state Bureau of Cannabis Control (BCC), which was reportedly fast to respond to retailers asking for permission to perform curbside pickups for customers.

As of Tuesday afternoon, the state had issued no clear mandates for how the MJ industry should continue to operate, which only added to the uncertainty around how the coronavirus will affect California’s cannabis industry in weeks and months to come.

“It’s an hour-by-hour and day-by-day period that we’re in, adapting and adjusting to the changes,” said Josh Drayton, spokesman for the California Cannabis Industry Association.

Drayton praised the BCC for its rapid response to allow curbside pickup, and added: “As of right now, we’re seeing one-off decisions, but they’re making them very quickly.”

BCC spokesman Alex Traverso wrote in an email to Marijuana Business Daily that the agency is answering questions from industry stakeholders as quickly as possible.

“Licensees can request relief from specific licensing requirements under Section 5038 Disaster Relief. We are responding to those requests through the bcc@dca.ca.gov email box,” Traverso wrote.

The lack of statewide guidance was illustrated Monday by an industry missive to Gov. Gavin Newsom. The letter, signed by several dozen marijuana businesses, implored Newsom not to cut off consumer access to cannabis.

“As retail businesses, like pharmacies, that provide medicinal and therapeutic products to millions of Californians, licensed cannabis dispensaries should not be included in any future guidance or order to shut down,” the letter stresses.

San Francisco stop-and-start

Regulators in San Francisco took the most drastic step to date of any California locality, telling all cannabis shops and delivery services on Monday to halt all sales because marijuana companies were classified as “nonessential” services.

That led many to send employees home on Tuesday as business owners crossed their fingers that the city would change its mind.

“It’s Day One, hour three, so it’s really hard to gauge what the impacts are going to be,” Martin Olive, co-owner of San Francisco cannabis retailer the Vapor Room, said at midday Tuesday.

The city appeared to rescind the order just hours later, when the San Francisco Department of Public Health wrote on Twitter: “Dispensaries can continue to operate as essential businesses during this time, while practicing social distancing and other public health recommendations.”

Before that announcement, Olive said the closure “could hypothetically bankrupt us.”

San Francisco marijuana retailer Sparc got permission from the BCC to perform curbside pickups, in part because owner Erich Pearson was confident the retail shutdown wouldn’t last.

After the city changed its order Tuesday, Pearson said he was “relieved” and that all his shops would open to the public starting Wednesday.

Even so, he said he had to furlough about half his employees on Tuesday, and Sparc wasn’t operating within San Francisco.

Pearson added that Sparc was positioned well to handle challenges around the virus because it’s been building out its delivery operation for months.

Sparc holds a state delivery license as well as permits for three storefronts in San Francisco and two in Sonoma County.

“Any (retailer) who doesn’t deliver is going to be more vulnerable” to financial troubles because of the coronavirus, Pearson said.

Huge sales numbers

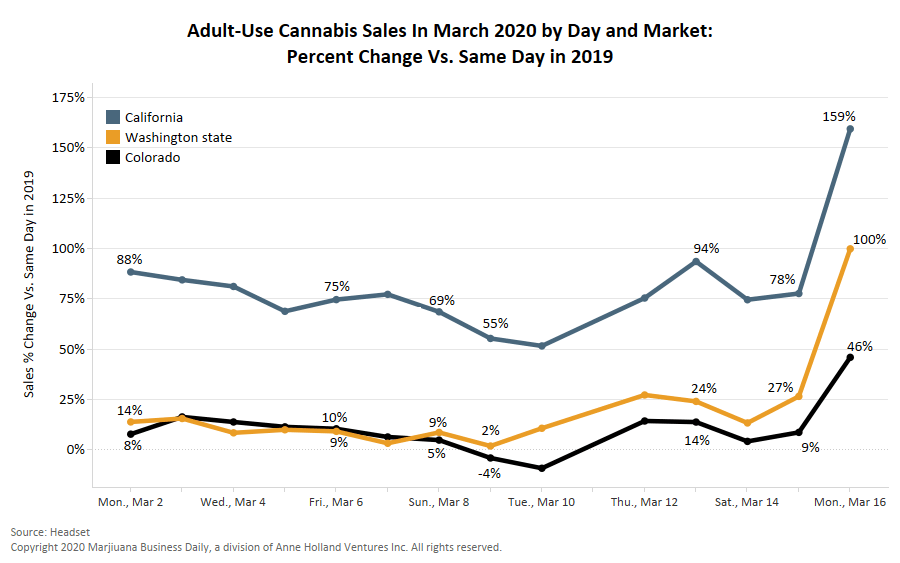

Legal marijuana retailers in California reported record sales numbers in recent days.

“(Monday) was probably the busiest day we have had since the first day of recreational sales” in January 2018, said Eliot Dobris, spokesman for San Francisco cannabis retailer The Apothecarium.

The Vapor Room’s Olive estimated sales at his shop were up as much as 70% in recent days before he had to shut down temporarily Tuesday.

The same was true in other parts of the state.

San Diego-based Driven Deliveries reported in a news release that its sales were up 43% week-over-week, and it’s hiring additional drivers and increasing inventory to better serve customers.

“Demand has increased exponentially,” said Doug Chloupek, CEO of Redwood City-based delivery service Juva. “I have not had to furlough or lay off any employees. For that matter, we’ve been able to expedite the hiring of two new employees as of today.”

Longer-term impacts?

But Chloupek is still worried, noting that his company’s corporate headquarters is closed and most employees are working remotely because it’s in San Mateo County – one of the seven Bay Area counties that issued a “shelter-in-place” order that is in effect until April 7. That order mandated the closure of most local businesses.

“We’d be naive to be anything but concerned. There’s no telling if this is going to be a three-week order or a two-month order,” Chloupek said. “All we can do is prepare as best we can with the information on hand.”

Overriding uncertainty remains as to what effect the virus – and the ensuing business upheaval in the cannabis industry – will have in the long term.

“That’s the million-dollar question,” said Johnny Delaplane, president of the San Francisco Cannabis Retailers Alliance.

That’s especially true because much of the California marijuana industry was already on thin ice financially due to months of supply-chain stress, unpaid vendor bills causing ripple effects and a widespread cash crunch.

“It really remains to be seen. First things first, we have to keep retail open, or the supply chain will collapse,” Delaplane said.

“Is this going to be an extinction event for a handful of cannabis businesses that may have made it otherwise? Definitely. I know there are people running out of money.”

Sparc’s Pearson predicted that retailers will be the first to see major troubles, followed closely by brands and companies that are heavily reliant on those retailers.

“This is the final straw on the camel’s back for a lot of businesses who have been struggling as a result of a poor retail environment,” Pearson predicted.

John Schroyer can be reached at johns@mjbizdaily.com

For more of Marijuana Business Daily’s ongoing coverage of the coronavirus pandemic and its effects on the cannabis industry, click here.