While California has the potential to be the largest legal cannabis market in the world, the state still lags other recreational markets in per capita sales – due in large part to the continued prominence of the illicit marijuana market and restrictive regulations.

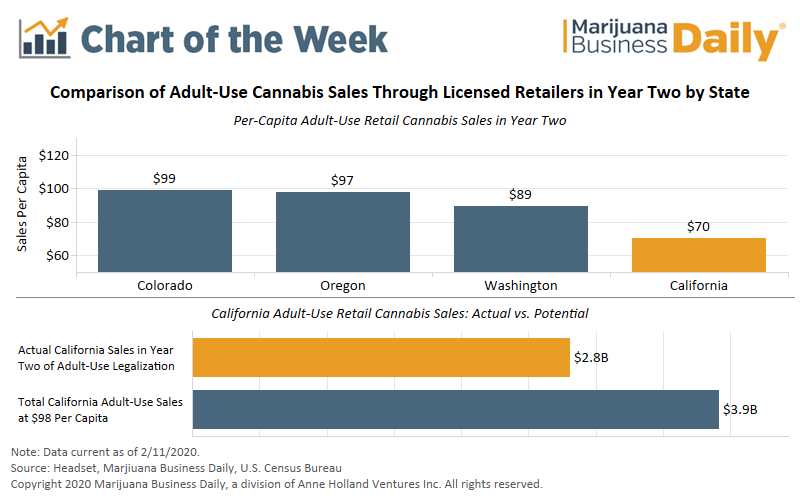

California’s per capita cannabis sales by the second year of operations only added up to $70 per customer. By comparison, Year two per capita sales in Colorado were $99, Oregon’s were $97 and Washington state’s $89.

If California’s market was more on par with the performance of these other state cannabis markets, it likely would have seen an additional $1 billion in sales in its second year.

The discrepancy can be attributed to many factors, including:

- The strength and resilience of the illicit market in California, which continues to capture a significant amount of consumer cannabis spending.

- Price differences between legal and illegal cannabis. The illegal market is not subject to the 30%+ retail tax rate consumers pay in most cities nor the $9.65 per ounce tax on wholesale adult-use cannabis.

- Limitations set by California municipalities on where cannabis businesses can operate.

If the legal marijuana market in California can overcome these hurdles, there’s a significant runway for sales growth.

Because the state and local tax rates remain sky-high, legal retailers simply cannot compete on price with the illicit market.

One Los Angeles cannabis retailer, for example, said that even though he’d seen an uptick in foot traffic in January after California-based online advertising giant Weedmaps stopped advertising for unlicensed marijuana shops, his average customer purchase amount had nose-dived – meaning that the increase in customers was almost a wash when it came to actual store revenue.

Several cities and counties, including Oakland and Monterey County, have already lowered taxes in response to industry outcries and warnings that high cannabis taxes in California are keeping the underground market alive.

It remains unclear how effective these steps will be in the long run.

John Schroyer can be reached at johns@mjbizdaily.com

Eli McVey can be reached at elim@mjbizdaily.com