Aurora Cannabis has agreed to acquire rival Canadian cannabis producer MedReleaf in a deal valued at $3.2 billion Canadian dollars ($2.5 billion) that would create the largest marijuana company in the world.

The transaction, announced Monday, marks the largest deal inked in the cannabis sector to date, giving the combined company a footprint that will span 11 countries with a distribution reach into Europe, South America and Australia.

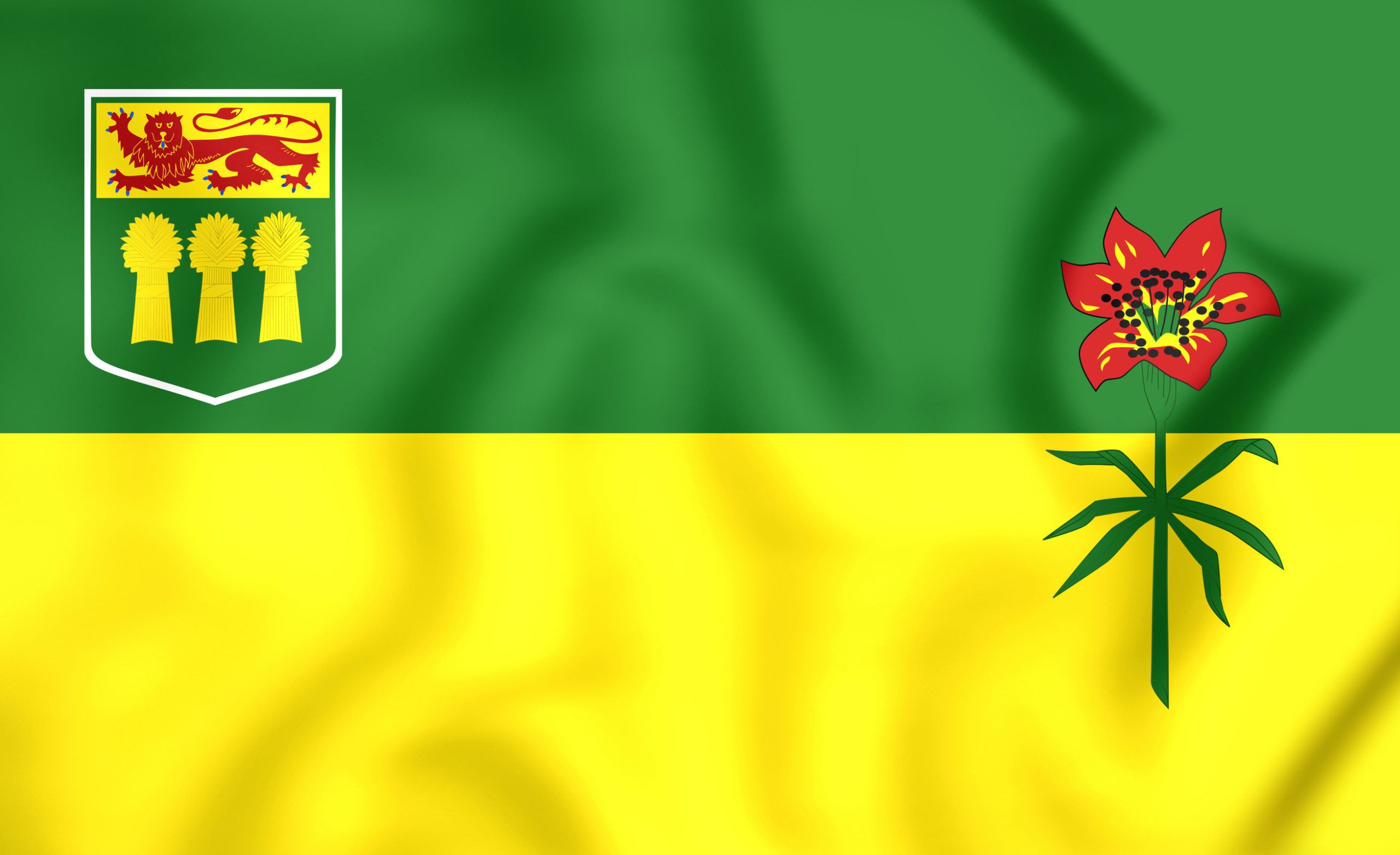

Under the deal, Edmonton, Alberta-based Aurora would have the capacity to produce 570,000 kilograms of cannabis a year across nearly a dozen operations in Canada and Denmark.

Folding in MedReleaf’s quarterly sales of CA$11.4 million, Aurora’s projected quarterly revenue is expected to ring in at CA$26.1 million – just ahead of the current No. 1, Canopy Growth, which reported CA$21.7 million in revenue for the quarter ended Dec. 31.

“We are creating the largest cannabis producer in the world,” Aurora’s chief corporate officer, Cam Battley, said during a conference call with reporters and investors.

Under terms of Monday’s deal, MedReleaf shareholders will receive 3.57 shares of Aurora for each share of MedReleaf that they hold.

Upon completion, Aurora and MedReleaf shareholders would own about 61% and 39% of the merged company, respectively.

Ontario-based MedReleaf trades on the Toronto Stock Exchange as LEAF and Aurora as ACB.

The acquisition is expected to close by August, following shareholder and board approvals.

Consolidation underway

The megadeal is part of a continued consolidation underway in both the cannabis industry and Canada, which is preparing for legal recreational use, expected later this year.

“I think we’re going to continue to see a lot more (consolidation),” said Alan Brochstein, a cannabis industry analyst and founder of 420 Investor. “I think now, we’re going to start seeing deals from pharmaceutical, alcohol and tobacco companies.

“It doesn’t take a lot of money for an institutional investor to get a toehold in the space.”

For Aurora, the deal furthers a buying spree it began two years ago and most recently included:

- A CA$1.2 billion acquisition of CanniMed Therapeutics.

- A major ownership stake in Canada’s Green Organic Dutchman.

Until the MedReleaf acquisition, Aurora’s deal with of CanniMed had been the industry’s largest.

The deal also signals increased interest in the cannabis industry from major traditional banking institutions. BMO Capital Markets served as the financial adviser to Aurora in the deal, while marijuana industry investment leader Canaccord Genuity advised MedReleaf.

Company officials said Monday that it’s too soon to know the structure of the combined company’s executive leadership.

Lisa Bernard-Kuhn can be reached at lisabk@mjbizdaily.com

To sign up for our weekly Canada marijuana business newsletter, click here.